How We Look at Potential Deals - Part 1

- Aaron Reber

- Apr 4, 2023

- 2 min read

A number of people we talk to ask questions like, “How do you find properties to invest in?” or “How do you structure the deal?” So we thought we’d lay it out on the table for you to see a little bit about how the sausage is made, so to speak.

We’ve built relationships with a number of brokers in our target markets that feed us off-market deals to vet. Off-market means these properties haven’t been listed for sale yet, but the seller is working with the broker to start the process. This means we have a small window where we can build a preliminary business plan and make an offer before the property is actually listed.

When we receive the spec sheet from the broker, we immediately get to work building a quick preliminary model to see if there’s any reason we’d want to pursue a full analysis of the property. Our quick model looks at these major variables we use to determine the likelihood that we’d pursue this deal any further.

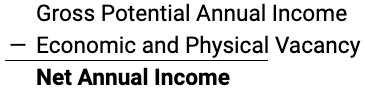

First, we subtract the Economic and Physical Vacancy from the Gross Potential Annual Income. This equation is noted below and gives us the Net Annual Income.

Next, we subtract the Annual Expense Rate, giving us the Net Operating Income.

We then apply the Annual Cap Rate as indicated by the broker. This gives us our initial Market Valuation for the property.

If the seller is asking for 20% more than our calculated market valuation, we throw it in the bin and move on. If their asking price is closer to that number, we dig deeper into the numbers and come back to them with a letter of intent to purchase the property. More to come on this!

Comments